The Financial Advisor Marketing Trends Report is a comprehensive study of over 400 financial advisors. The study is designed to help financial professionals stay ahead of the curve and make informed decisions about their growth marketing strategies.

| 403 financial advisors across the US | Primarily from IBD and RIA firms | $100M+ in AUM | Fielded in October - November 2023 |

Research conducted in partnership with 8 Acre Perspective, an independent marketing research firm hired by Broadridge.

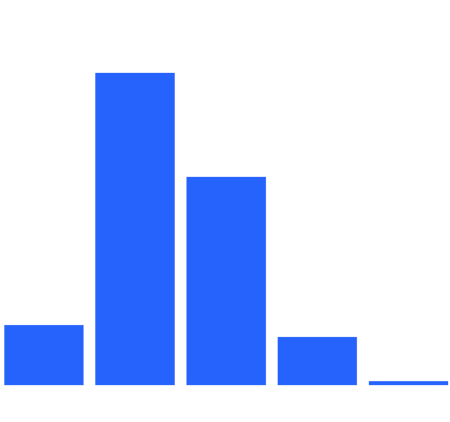

Strategic marketing is strongly associated with better business outcomes

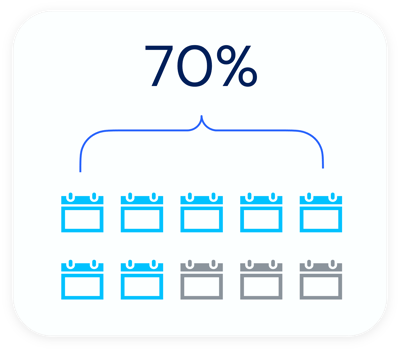

Strategic marketing is strongly associated with better business outcomesAdvisors who have invested in a defined marketing strategy report more robust results across crucial business areas, yet less than 30% of advisors have one.

Generate 168% more leads each month

Onboard 50% more clients every year

42% more likely to convert a social media lead into a client

34% more confident in their business growth

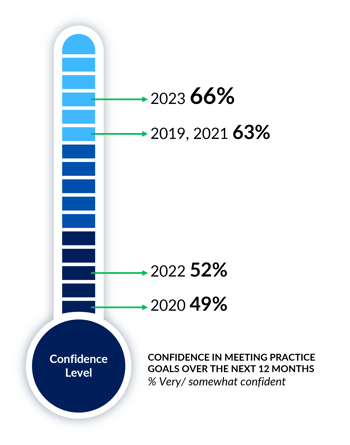

66% of advisors are confident they'll meet practice goals this year

66% of advisors are confident they'll meet practice goals this yearAfter several years of market volatility, advisors’ confidence is at the highest level observed (66%) since the study began five years ago.

The financial advisory sector is on the rise due to powerful trends, such as intergenerational wealth transfer, technological advancements, and growing awareness of financial planning. These trends are creating opportunities for advisors to expand their client base and provide valuable services in an evolving and dynamic market.

Not surprisingly, advisors with more assets under management ($50M+ AUM), those with a defined marketing strategy and those with larger marketing budgets ($10k+) expressed greater confidence in meeting practice growth goals.

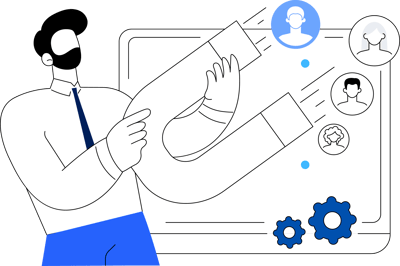

58% of advisors are actively focused on acquiring new clients

58% of advisors are actively focused on acquiring new clientsWith the increasing demand for financial advice and services, advisors recognize the importance of attracting new clients to stay ahead in the market.

Although acquiring new clients is a priority for many advisors, it is also important for them to focus on providing exceptional service to existing clients. By maintaining strong relationships with current clients and delivering high-quality financial advice, advisors can build trust and loyalty, ultimately leading to client retention and referrals.

RIA advisors and, not surprisingly, younger advisors (< age 55) are more likely to be actively adding new clients.

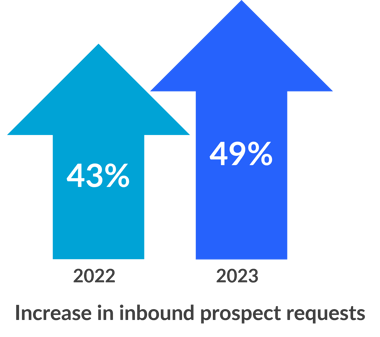

The financial advisory industry is a rapidly expanding sector with an increasing demand for planning services and financial products. According to the U.S. Bureau of Labor Statistics, the industry is expected to grow by 5% during the next decade1. Nearly half of advisors have reported an increase in the number of inbound prospect requests, indicating a greater demand for their services.

This growth can be attributed to several factors, including the increasing complexity of financial markets, the growing number of high-net-worth individuals, and the need for personalized financial advice2. The industry is also experiencing a wave of innovation driven by rapid technological advancements, fast-evolving consumer needs and behaviors, and an environment of economic stimulus.

Growth-focused advisors, those offering planning, teams, and those managing $100M+ AUM are more likely to have experienced an increase in demand for their services.

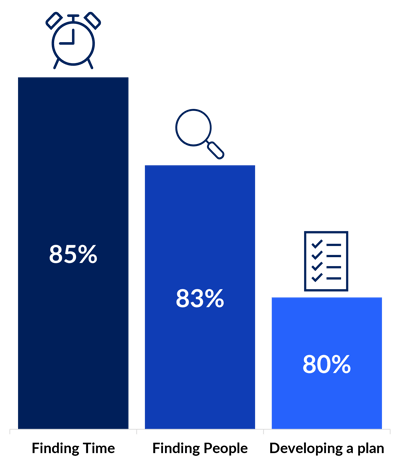

The biggest obstacles are:

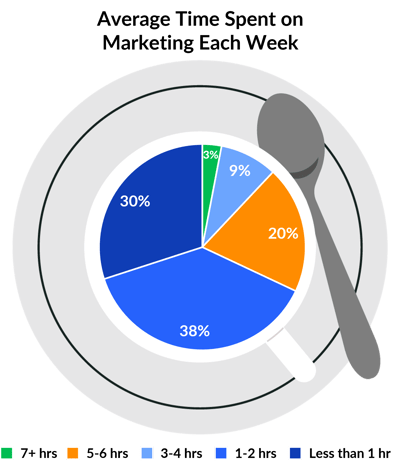

85% of advisors report that finding time for marketing is challenging

85% of advisors report that finding time for marketing is challengingThis year’s survey reveals that 80% of advisors handle their own marketing, which indicates they’re taking a hands-on approach to promoting their services.

Eighty-five percent of advisors find it challenging to allocate time for marketing efforts, with advisors spending 2.1 hours per week on marketing efforts, on average.

Not surprisingly, advisors on teams and those managing higher AUM ($100M+) are more likely to have in-house marketing staff, suggesting that larger practices may have the resources to dedicate to marketing efforts.

These findings highlight the challenges and time constraints that advisors face in managing their marketing efforts, prompting consideration of the most efficient use of their time. As the financial advisory landscape continues to evolve, it will be crucial for advisors to find the right balance in their marketing strategies to reach and engage with potential clients effectively.

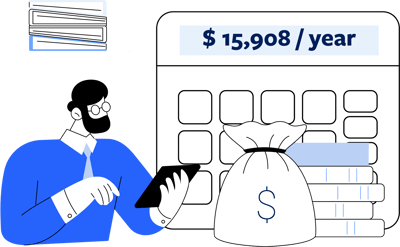

Advisors spend an average of $15,908/year on marketing

Advisors spend an average of $15,908/year on marketingThe median marketing spend remains unchanged in four years at $6,250. Most of the advisors surveyed expected to maintain their marketing spend during the next 12 months, while 31% anticipate increasing their budgets.

There are stark contrasts in who prioritizes marketing investments:

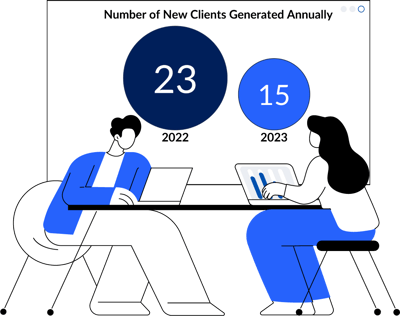

Advisors acquired 15 clients at $609 each on average

Advisors acquired 15 clients at $609 each on averageAdopting proven growth strategies translates into more new clients. Advisors who have a defined marketing strategy onboarded 50% more clients this year, translating to an average of 21 new clients onboarded. Advisors without a strategy brought in only 14 new clients.

Advisors overseeing at least $100 million in assets under management incur an average cost of $742 per new client. Growth-focused advisors invest significantly more in new client acquisition, averaging $997 per new client.

Advisors are spending evenly on client acquisition and retention

Advisors are spending evenly on client acquisition and retentionAdvisors are allocating more evenly between client acquisition and retention, signaling a shift from the traditional emphasis on acquiring new clients.

This balanced approach underscores a deeper understanding of the long-term benefits that a loyal client base provides. By allocating resources evenly, advisors can optimize their marketing efforts, leveraging a comprehensive strategy that secures new business and helps increase AUM from these existing relationships.

It’s worth noting, however, that some advisors still prioritize new client acquisition. For instance, growth-focused advisors allocate a significantly larger portion of their marketing budgets (55%) to acquiring new clients compared to non-growth-focused advisors (44%).

Boomers and Gen-X are the primary targets

Boomers and Gen-X are the primary targetsAdvisors predominantly target their marketing toward Gen X and Boomers because of their accumulated wealth and impending retirements.

Members of these generations are seen as a more lucrative market for retirement planning, wealth management, and estate planning services. Their profitability diminishes as these clients age and transition to the decumulation phase.

Advisors recognize the importance of balancing the immediate need to service profitable clients with investment in younger generations for sustained growth. Advisors plan to target Millennials and, to a lesser extent, Gen Z, to cultivate future opportunities.

Websites are the most popular marketing investment

Websites are the most popular marketing investmentA vast majority of advisors (98%) say they plan to spend the same or increase their spending on websites in the next 12 months.

Referral programs, social media, digital newsletters, and in-person events lagged behind, but still garnered significant investment.

62% of advisors find their website ineffective at generating leads

62% of advisors find their website ineffective at generating leadsAdvisors generate an average of two and a half leads per month from their websites.

Thirty-eight percent don’t believe their website generates any leads.

Advisors with a defined marketing plan generated 168% more leads per month from their website compared to those without a defined marketing plan.

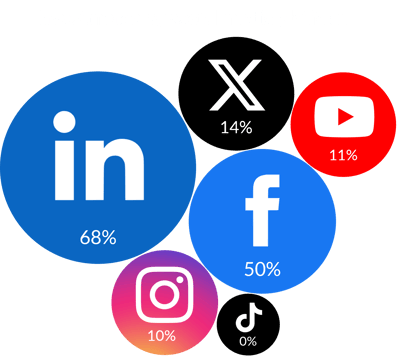

Social media continues to be an important channel for conversions

Social media continues to be an important channel for conversionsAdvisors say that client referrals convert twice as quickly as marketing prospects, but social media continues to be an important channel. Four in ten advisors say they’ve obtained clients via social — a number that has stayed stable for several years.

LinkedIn and Facebook have the highest conversion rates. Since LinkedIn caters to a professional audience, it’s a valuable space for advisors to showcase their expertise. On the other hand, Facebook’s more personal nature helps advisors to build rapport and trust with prospective clients.

LinkedIn remains the top social channel for advisors

LinkedIn remains the top social channel for advisorsSixty-eight percent of advisors invest in LinkedIn, and 50% do so on Facebook, making those platforms the biggest recipients of advisor marketing dollars.

LinkedIn is most popular among advisors 55+, while planners and those with balanced practices are more likely to invest in Facebook than advisors who focus primarily on investment management.

7 in 10 advisors had success obtaining leads through hosting events

7 in 10 advisors had success obtaining leads through hosting eventsHosting webinars, seminars, and workshops helps advisors showcase financial planning and investing expertise. By providing tangible value, advisors can nurture a pool of prospects ripe for conversion.

Advisors under age 45 are more likely to have hosted educational events versus their older colleagues.

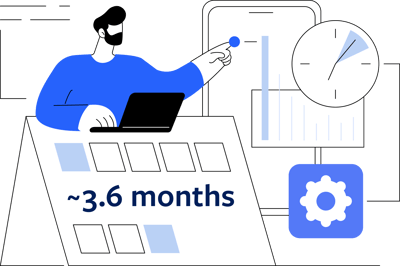

It takes ~3.6 months for a marketing prospect to become a client

It takes ~3.6 months for a marketing prospect to become a clientClient referrals come with a built-in foundation of trust and credibility, reducing the time advisors spend establishing these essential qualities with potential clients. Advisors report that client referrals take an average of nearly two months (1.7) to convert to clients.

Most marketing leads will not have that pre-established level of trust, so it will take more time for them to convert into clients. This wave, Advisors state that leads from other marketing initiatives take an average of nearly four months (3.6) to convert into clients.

Crafting strategic content through channels such as blogs, webinars, and newsletters can accelerate the trust-building process, potentially shortening the conversion timeline to align more closely with the speed of referral prospects.

53% of investors want financial education from their advisor

53% of investors want financial education from their advisorInvestors highly appreciate advisors who keep them up to date with the ever-evolving financial landscape.

By providing education on emerging trends and financial matters, advisors can position themselves as industry thought leaders and foster a sense of trust with their clients.

Lack of time and confusion on how to execute were among the top obstacles for why advisors communicate annually or less often.

Providing on-going financial literacy can be done easily by sharing newsletters, high-value news content, and social media postings to provide valuable information to clients.

It’s important for advisors to use these channels in a way that is not spammy or annoying to investors. For example, advisors can use social media to share informative articles or market updates rather than bombarding clients with promotional content.

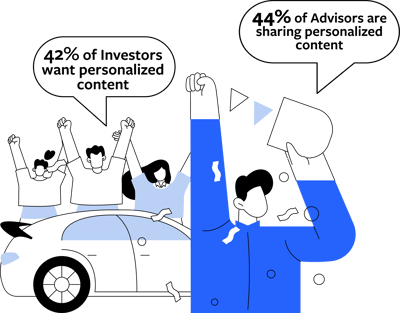

Only 44% of advisors are sharing personalized content

Only 44% of advisors are sharing personalized contentA study by Dow Jones found that 42% of investors felt their advisor could add greater value simply by sharing content and communications personalized to their interests, financial goals and life events.

Yet only 4 in 10 advisors are sharing personalized content with investors, underscoring an opportunity to increase client satisfaction and referrals.

Financial advisors can use content marketing to demonstrate that they understand their client’s goals. By sharing content that is tailored to their client’s specific needs, advisors can establish themselves as trusted experts.

Advisors are not meeting investor expectations on communication frequency

Advisors are not meeting investor expectations on communication frequencyInvestors want advisors to communicate on a weekly cadence, and 74% of advisors are not meeting that frequency.

Only 26% of advisors are meeting expectations in contact frequency.

Investors want advisors to communicate on a weekly cadence, yet only 26% of advisors are doing so.

Advisors who maintain frequent communication with their clients have a significantly higher chance of achieving meaningful results from their marketing endeavors compared to those who communicate sparingly.

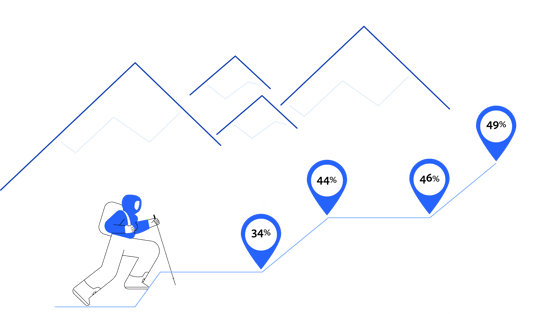

More confident they'll reach

their growth goals

Had an increase

inbound prospects requests

More likely to personalize content

shared with clients and prospects

The potential for AI to streamline processes and further personalize client experiences holds promise, making it a compelling avenue for future innovation.

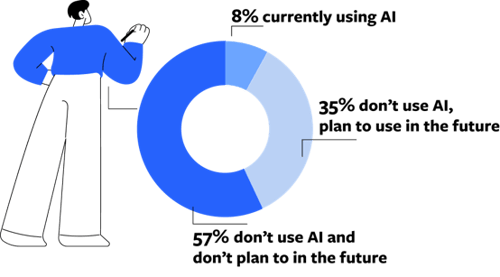

Only 8% of advisors use AI in their marketing efforts

Only 8% of advisors use AI in their marketing effortsNotably, AI usage is more common among younger and growth-focused advisors, who prioritize modern productivity tools in their marketing approaches.

But that is likely to change as 35% of advisors plan to use AI in the future.

AI has the potential to revolutionize the financial advisory industry by improving efficiency, reducing costs, and enhancing the quality of services provided to clients.

The top ways advisors plan to use AI:

62% generating personalized content

45% personalizing marketing campaigns

41% automating admin tasks and communications

22% segmenting clients or prospects

You don't need to be a professional marketer to turn these insights into action. Simply contact Broadridge, and we'll set you up with a marketing program for success.